We assist companies from other countries to establish themselves in Scandinavia

SCANDINAVIAN EXPANSION GROUP

We establish a project for each client and go through and finalise their goals and plans for our Scandinavian market. In these projects we use our experience and connections to make your company succeed in Scandinavia.

Hire Us

Scandinavian Expansion Group support you in getting the best possible start on the Scandinavian market by finding the right distributors, suppliers and other partners.

Contact form

+46 (0)735 162090

CONTACT US

The Scandinavian Market

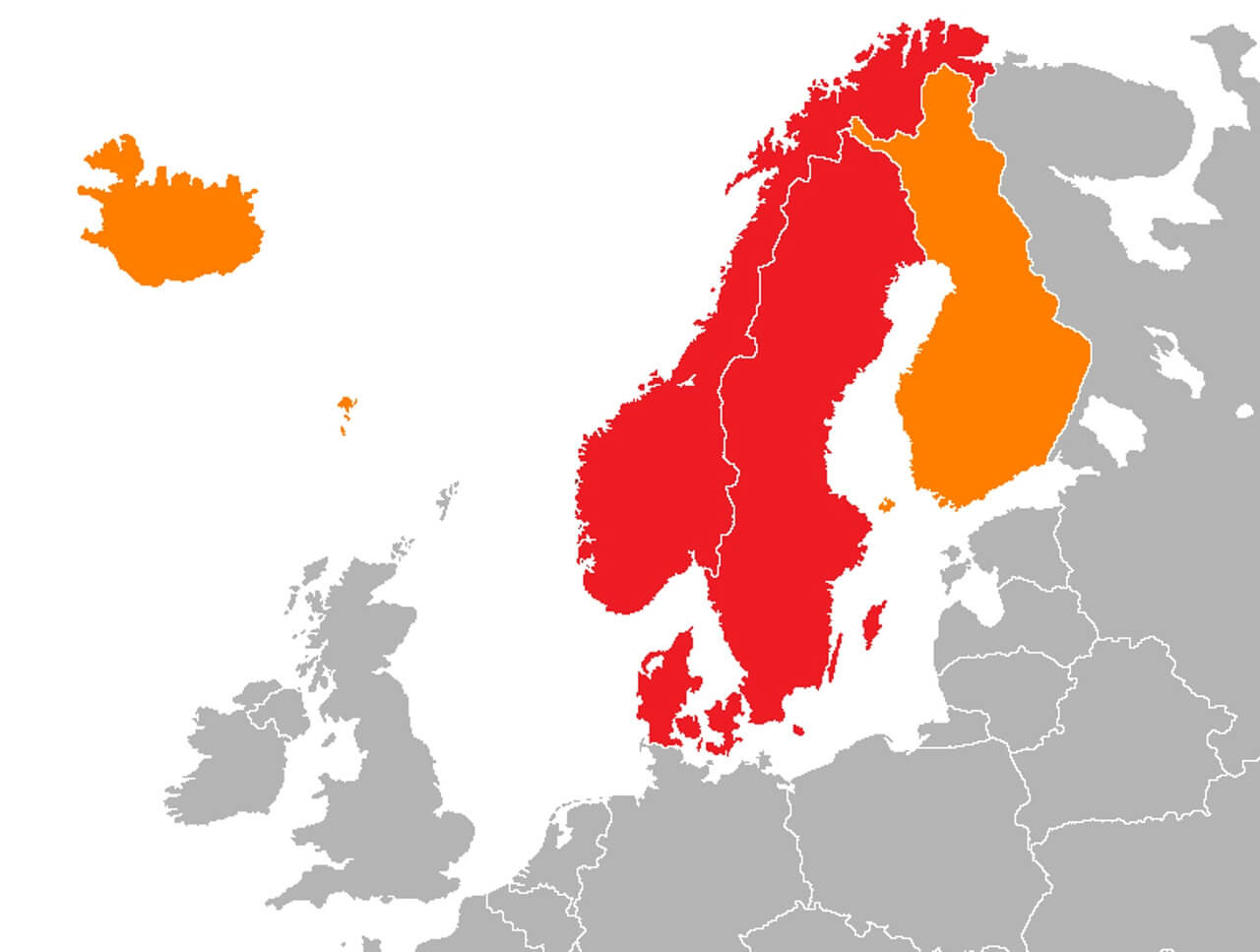

The three monarchies (Denmark, Norway, and Sweden) that compose Scandinavia according to the local definition

The extended usage in English which includes Iceland and the Faroe Islands, the Åland Islands, and Finland.

The Nordic region is often referred to as a single, homogeneous retail economy. Although they share some socio-political and cultural similarities, Denmark, Finland, Norway and Sweden each have a distinct retail marketplace. This is evident in economic structure and cycles, legal frameworks, the retail hierarchy and consumer behavior. Understanding these differences is essential to identifying the opportunities in each country, requiring the development of asset management and retailer strategies tailored to each market.

The countries are all small, open, export-led, mixed economies. However, the composition of the underlying export markets varies significantly, resulting in divergent economic performance and prospects.

- The region is affluent and wealth is widely distributed across the populations, with the Norwegians being the most affluent and the Finns the least. Focusing on comparative wealth within the region, however, might mistakenly lead to Finland being discounted given its spending potential significantly exceeds the EU average.

- The retail landscape is dominated by shopping centres in Finland, Norway and Sweden, in part due to the harsh winter climate that favours enclosed retail formats. This is mirrored in shopping behaviour, with up to 40% of consumers visiting shopping centres at least once a week, in Norway, Sweden and Finland, while this falls to a little over 20% in Denmark. (In Denmark, high-street retailing predominates.)

- Retailers must be cognisant of the different consumer attitudes, currencies, regulations and competitors within each market. For example, Sunday trading hours vary across the markets and, while consumerist, Swedes are price conscious while Norwegians favour locally sourced products.

- The youngest (16-24) and oldest (55-65) age cohorts have the strongest preference for shopping centres in Denmark, Norway and Sweden. In Finland, the 25-34 years olds are more engaged.

- In addition to visiting stores, which remains the principal reason for visiting shopping centres, consumers also identify shopping centres as social spaces, with a strong propensity to meet friends when they visit. This is particularly strong amongst the younger age profile. Although this supports food and beverage (F&B) services in shopping centres, the level of engagement is lower across all Nordic markets compared with other European countries. Yet, consumers also indicated that increasing the F&B offer would encourage them to frequent shopping centres more often.

- The penetration of international retailers is low relative to other European markets. To some extent this is due to strong domestic brands in key segments (e.g., fastfashion) but also as a result of a lack of understanding of the opportunities in each market. The consumer opportunity in these more affluent markets and a shift towards city- rather than country- led expansion strategies, is increasing cross-border retailer activity in the region. Such retailers are focused on either capital or major cities and in comparison to domestic brands, are hesitant to expand to what might be considered more secondary cities/locations.

- The perception of the Nordic markets differs amongst retailers, and this is manifest in business strategies. Retailers from within the Nordics region view each country as a discrete market and tailor strategies accordingly, with store networks managed at a national level. In contrast, international retailers have a tendency to consider the region as one homogeneous market and manage it accordingly

![]() Denmark, Constitutional monarchy with a Parliamentary system

Denmark, Constitutional monarchy with a Parliamentary system

![]() Norway, Constitutional monarchy with a Parliamentary system

Norway, Constitutional monarchy with a Parliamentary system

![]() Sweden, Ceremonial monarchy with a Parliamentary system

Sweden, Ceremonial monarchy with a Parliamentary system

![]() Finland, Parliamentary republic

Finland, Parliamentary republic

![]() Iceland, Parliamentary republic

Iceland, Parliamentary republic

![]() Åland, Islands an autonomous province of Finland since 1920

Åland, Islands an autonomous province of Finland since 1920

![]() Faroe Islands, an autonomous country within the Danish Realm, self-governed since 1948

Faroe Islands, an autonomous country within the Danish Realm, self-governed since 1948

![]() Greenland, an autonomous country within the Danish Realm, self-governed since 1979

Greenland, an autonomous country within the Danish Realm, self-governed since 1979

![]() Svalbard, which is under Norwegian sovereignty, is not considered part of Scandinavia as a cultural-historical region; but as a part of the Kingdom of Norway since 1925, it is part of the Nordic countries Norden.

Svalbard, which is under Norwegian sovereignty, is not considered part of Scandinavia as a cultural-historical region; but as a part of the Kingdom of Norway since 1925, it is part of the Nordic countries Norden.